聚光灯

分析员、信贷产品干事、股票研究分析员、金融分析员、投资分析员、规划分析员、投资组合经理、房地产分析员、证券分析员、信托干事

俗话说,赚钱需要钱,而投资是最常见的赚钱方式。从股票和债券到房地产和加密货币,投资是最屡试不爽的长期盈利方法之一。然而,投资本身也存在风险,因为市场会因影响公司和整体经济的因素而不断波动。投资回报的保证为零,完全有可能血本无归。

这就是为什么精明的投资者会求助于金融分析师的原因,因为金融分析师可以根据他们的预算、目标、风险承受能力和时间安排,为他们提供合适的策略建议。金融分析师研究股票、房地产和其他投资类型的表现,然后尝试预测未来的表现。由于其中有许多人为因素,因此这种分析既是一门艺术,也是一门科学。

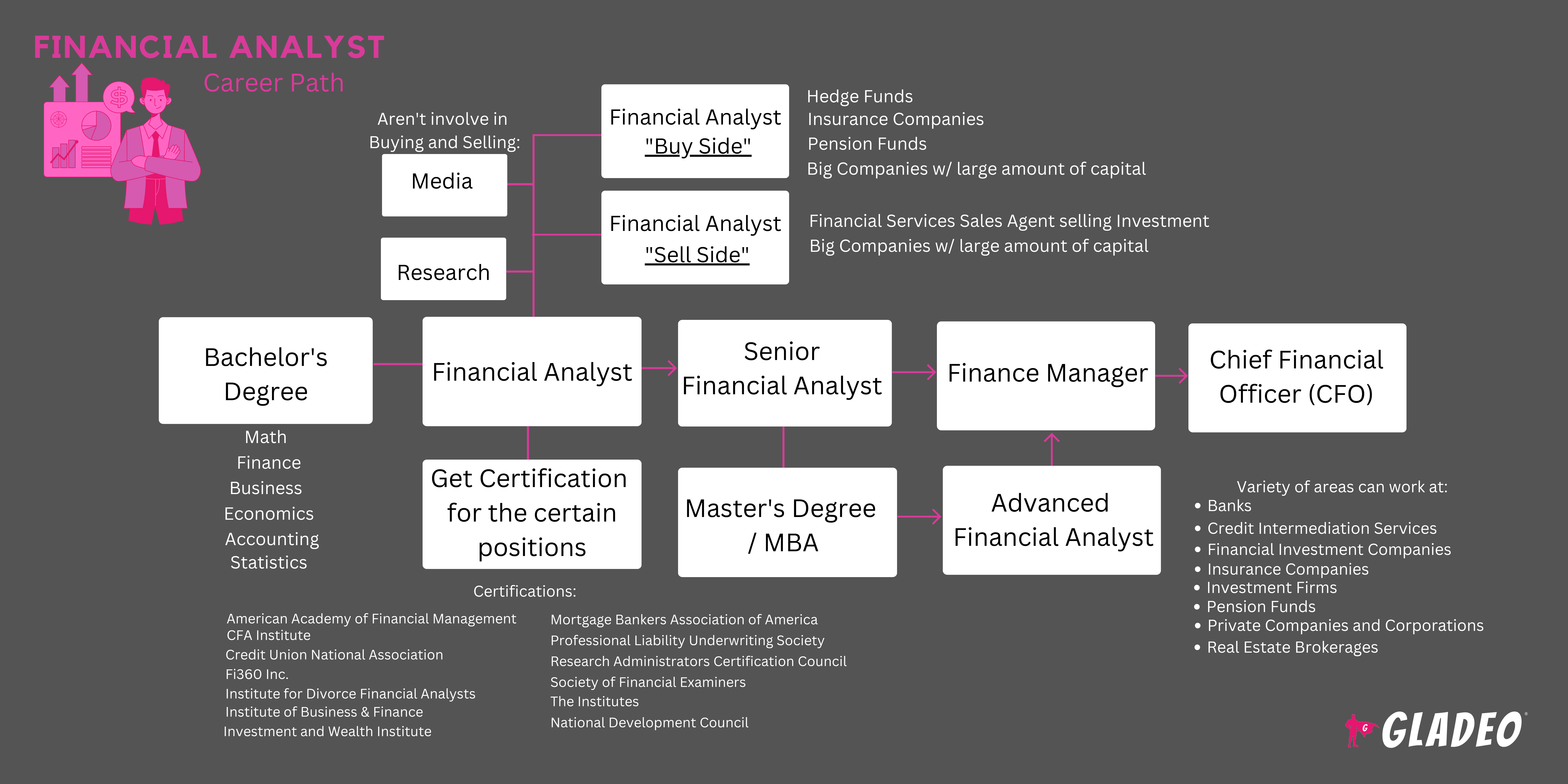

Generally speaking, Financial Analysts focus on either the “buy-side” (for hedge funds, insurance companies, pension funds, and big companies with large amounts of capital to invest) or the “sell-side” (for financial services sales agents selling investment options). Some work strictly for media and research employers who aren’t involved in buying or selling. They may specialize in particular regions, industries, or products.

金融分析是一个广泛的职业领域!金融分析师包括金融风险专家、基金和投资组合经理、投资分析师、评级分析师和证券分析师。每个职位的职责和范围各不相同,但都与充满活力的金融分析领域息息相关。

- 帮助雇主赚取用于公司或个人利益的利润

- 作为投资界的一员,投资对地球上的每个人都有经济影响

- Learning how equities (stocks), bonds, real assets (real estate, commodities like gold, oil), and cryptos function as investments

工作日程

财务分析员的工作时间通常是白天,根据客户需要,也有必要加班或晚上工作。工作地点通常在室内,有时需要出差。

典型职责

- Review client financials (income statements, balance sheets, cash flow) to assess their capital needs, investment budgets, and risk tolerance

- 考虑向客户推荐的投资类型和投资组合

- 提出投资补救、债务重组、再融资以及其他解决雇主财务问题的建议

- 编写报告和演示材料,并配以图表说明,帮助客户了解各种选择方案

- 研究其股票可能成为良好投资的公司。根据需要进行实地考察

- 评估历史房地产销售数据,预测房地产是否是一项可行的投资

- 利用财务模型和程序协助制定投资战略

- 关注地方、国家和全球经济及商业趋势

- 为金融投资、交易和买卖制定并执行经批准的行动计划

- 与投资银行家、会计师、公关人员、律师及其他相关人员合作

- 评估现有投资业绩,提出调整或出售建议

- 寻找新机遇,实现多样化,提高潜在利润,降低风险

- 比较不同行业的证券

- 分析有关价格、收益和稳定性的数据

- 根据需要与政府机构合作。确保遵守法规和法律

- 帮助客户了解投资的税务影响

额外责任

- 通过阅读金融出版物了解最新信息

- Find “green” investment opportunities

- 根据需要,宣传服务以吸引新客户

- 培训和指导新的分析员

软技能

- 积极倾听

- 适应性

- 分析性的

- 以合规为导向

- 批判性思维

- 注重细节

- 纪律

- 金融敏锐度

- 耐心

- 坚持不懈

- 劝说

- 规划和组织

- 解决问题的能力

- 怀疑论

- 健全的判断力

- 强大的沟通能力

- 团队合作

- 时间管理

技术技能

- 数学和会计技能

- 对经济和投资有深刻理解

- Familiarity with applicable laws governing the securities industry, such as:

- 2010 年《多德-弗兰克华尔街改革和消费者保护法

- 1940 年投资顾问法

- 1940 年投资公司法

- 2012 年创业法案

- 2002 年《萨班斯-奥克斯利法案

- 1933 年证券法

- 1934 年证券交易法

- 1939 年信托契约法

- Analytical software such as SAS, MATLAB, Spotfire, QlikView, Tableau, and MicroStrategy

- Other digital tools including Excel, SQL, VBA, Python, and R

- 银行

- 信贷中介服务

- 金融投资公司

- 保险公司

- 养老基金

- 私营公司和企业

- 房地产经纪人

投资者非常依赖其金融分析师团队的专业知识。合理的投资可以带来长期的盈利能力和稳定性,这往往意味着公司员工可以持续工作。错误的投资可能会导致企业遭受重大财务损失,进而导致裁员、解雇员工甚至破产。

Expectations run high and Financial Analysts must work hard to conduct thorough research and create accurate models to forecast the best investments for their clients’ needs. As Zippia points out, “while financial analysts are usually paid well, it comes at the cost of a healthy work-life balance in many cases.” Potentially long hours and the stress from so much pressure causes some analysts to experience burnout.

The economy has been seeing turbulent times, with investors riding a rollercoaster as stocks, mutual funds, ETFs, real estate, and crypto prices have fluctuated in unpredictable ways. Such volatility is the opposite of what most Financial Analysts want to see when it comes to wealth building, yet there haven’t been many safe harbors lately. There are relatively safe options such as savings accounts, bonds, treasury bills, and similar items, but the return on such low-risk investments may not even keep up with inflation. Meanwhile, some analysts do suggest taking advantage of lowered stock prices, advocating a “buy the dip” strategy while stocks are “on sale.”

The digitalization of currency has become a growing trend, with plenty of investors viewing cryptocurrencies and NFTs (non-fungible tokens) as an intriguing alternative to traditional investment vehicles. Indeed, venture capitalists alone sank over $33 billion in crypto and blockchain in 2021. Meanwhile, trading apps have utterly revolutionized how everyday people trade, which in turn impacts the overall market greatly.

Financial Analysts may have always enjoyed learning about money, how it works, and how it can be used to make even more money! Growing up, they might have been entrepreneurs who launched their own side hustles online or in-person. They could have enjoyed playing around with stocks and cryptos, trading via mobile apps and engaging in online forums. It’s possible they liked math, finance, economics, and programming classes in school. Others might have come to them for help or advice about investments, leading them to realize they could turn their skills into a well-paid profession one day!

- 入门级金融分析师职位要求至少拥有经济学、金融、商业、数学或相关专业的学士学位

- 大型雇主可能需要拥有硕士学位(如 MBA)的分析师

- 某些分析员职位要求了解物理、应用数学和工程原理

- There are many certifications available which can help qualify you for certain positions. These include:

- American Academy of Financial Management - Accredited Financial Analyst

- CFA Institute - Chartered Financial Analyst

- Credit Union National Association - Certified Credit Union Investments Professional

- Fi360 Inc. - Accredited Investment Fiduciary

- Institute for Divorce Financial Analysts - Certified Divorce Financial Analyst

- Institute of Business & Finance -

• Certified Income Specialist

• Certified Funds Specialist

- Investment and Wealth Institute - Certified Investment Management Analyst

- Mortgage Bankers Association of America - Certified Residential Underwriter

- Professional Liability Underwriting Society - Registered Professional Liability Underwriter

- Research Administrators Certification Council - Certified Financial Research Administrator

- Society of Financial Examiners -

• Certified Financial Examiner - Financial Analyst

• Accredited Financial Examiner - Financial Analyst

- The Institutes - Associate in Commercial Underwriting

- National Development Council - Economic Development Finance Professional

- Financial Analysts who sell products need a license through the Financial Industry Regulatory Authority (FINRA). Licensures are typically obtained after an analyst starts working

- 尽早决定是否打算攻读硕士学位。在同一所学校完成学士学位和硕士学位可能会更容易一些。

- 考虑学费、折扣和当地奖学金机会(除联邦援助外)。

- 在决定是否报名参加校内、网上或混合课程时,要考虑你的时间安排和灵活性。

- 查看该项目教师的奖项和成就,看看他们都做了哪些工作

- 查看就业安置统计资料和该项目校友网络的详细信息

- 考虑申请会计或财务方面的兼职工作

- 努力学习数学、金融、经济、统计、商业、物理和计算机科学/编程课程

- 志愿参加学生活动,在活动中理财并学习实用的软技能

- 了解各种类型的金融分析师职位,例如金融风险专家、基金和投资组合经理、投资分析师、评级分析师和证券分析师

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working analysts to learn more about their jobs and their clients’ needs

- 在大学期间寻求实习和合作经历

- 记录可能成为未来工作推荐人的人的姓名和联系方式

- 学习与不同类型投资相关的书籍、文章和视频教程。参加在线讨论组,这些讨论组都是真实的,以实际分析为基础

- 考虑您是否想专门从事某一特定地区、行业或投资类型的工作,以便相应地调整您的教育内容

- 参与专业组织,学习、分享、交朋友,并扩大你的网络(见我们的资源清单>网站)。

- 尽快考取相关证书,以提高资历,增强在就业市场上的竞争力

- 尽早开始起草你的简历,并在起草过程中不断加以补充,这样你就不会失去任何线索

- 如果可能的话,在申请前积累一些实际工作经验。与金融、会计和商业相关的工作在申请表上会很好看

- 开始从事这一领域的工作并不需要硕士学位,但研究生学位可能会让您在竞争中处于领先地位

- Let your network know you are looking for work. Most job opportunities are actually discovered through personal connections

- Check out job portals such as Indeed, Simply Hired, and Glassdoor, as well as the career pages of companies you are interested in working for

- 仔细筛选广告,只有在你完全合格的情况下才能申请。

- 与金融相关的学徒或合作经历可以帮助您进入职场。这些经历在简历上看起来很不错,还能为日后提供一些个人推荐信

- 向在职金融分析师请教求职技巧

- Move to where the most job opportunities are! The states with the highest employment level for Financial Analysts are New York, California, Texas, Illinois, and Florida

- 许多大公司从当地的项目中招聘毕业生,所以请你学院的项目或职业中心帮助联系招聘人员和招聘会。

- Career centers also offer assistance with resume writing and mock interviewing!

- 提前询问以前的老师和主管,他们是否可以作为个人推荐人。不要在未经允许的情况下列出他们的联系信息,让他们措手不及。

- 在 Quora 上注册一个账户,向该领域的工作人员咨询工作建议问题

- Check out Financial Analyst resume templates to get ideas

- 根据你所申请的工作定制你的简历,而不是向每个雇主发送相同的简历。

- 在简历中列出所有教育、技能、培训和工作经历,包括投资回报统计(如适用)

- 考虑让专业的简历作家或编辑来起草或审查你的简历

- Financial Analyst interview questions to prepare for those interviews

- Dress appropriately for job interview success!

- 持续为你的雇主/客户赢得丰厚的投资回报,并为他们建立能够抵御经济风暴的投资组合

- 根据需要加班加点,确保为委托你管理资金的人尽心尽力

- 认真履行处理他人钱财的责任

- 了解并遵守所有法律和道德要求

- 利用最新的计划和技术实现收益最大化

- 尽可能多地了解财务分析的各个方面,同时专攻自己选择的领域

- 期望从初级职位做起,然后逐步晋升至责任更大的职位,如投资组合经理或基金经理

- Get your FINRA license as soon as you are able, and obtain advanced certificates when you have enough work experience

- One of the most common cers is the Chartered Financial Analyst credential offered by the CFA Institute

- 如果您还没有硕士学位,可以考虑在晚上一边工作一边学习 MBA 课程

- 当你准备好处理更多或更大的项目时,让你的经理知道

- 在团队中有效协作,保持冷静和专注,并在机会来临时展现领导力

- 通过参加专业组织来扩大你的网络

网站

- 美国财务管理学院

- 金融专业人士协会

- CFA协会

- 全国信贷联盟协会

- Fi360 公司

- 金融业监管局

- 全球金融与管理学院

- 离婚财务分析师协会

- Institute of Business & Finance

- 投资与财富研究所

- 美国抵押贷款银行家协会

- 国家发展委员会

- 专业责任承保协会

- 研究管理人员认证委员会

- 财务审查员协会

- 研究所

书籍

- Fundamental Analysis for Beginners: Grow Your Investment Portfolio Like A Pro Using Financial Statements and Ratios of Any Business with Zero Investing Experience Required, by A.Z Penn

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable Portfolio, by Michele Cagan CPA

- Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications, by John J. Murph

- The Essentials of Financial Analysis, by Samuel Weaver

金融分析师的工作有时会很有压力,尤其是在经济不景气、投资回报率较低的情况下。很多时候,分析师会因为一些他们无法控制的因素而受到指责。根据劳工统计局的数据,一些相关职业值得考虑,包括

- 预算分析师

- 财务经理

- 保险核算员

- 个人财务顾问

- 证券、商品和金融服务销售代理

In addition, O*Net Online lists the below-related fields:

- 信贷分析员

- 金融风险专家

- 投资基金经理

新闻联播

特色工作

在线课程和工具

年薪预期

新员工的起薪约为 7.6 万美元。年薪中位数为 9.9 万美元。经验丰富的员工年薪约为 12.9 万美元。